In

Stock/Commodity/Forex the moves on Intraday, short-term, medium-term dependant

on long term trend. Trading in intraday, short-term, medium-term time frames in

the direction of long term trend results in consistent profits. For this

purpose, we have identified the following setup with Moving Averages.

Here

in this set up, we will first follow 2 years (2Y) chart, where 1 days = 1 tick/

1 candle) of Nifty and plot 50, 100 and 200 EMA lines on the charts. Click

here to see the chart

Now,

on the chart click on Technical Indicators, select Exponential Moving Averages

and enter values 50, 100 and 200 (10, 20 and 50 for short term and 20, 50 and

100 for medium term) as shown in the following picture

This

will add 3 lines on the chart for 50 day EMA, 100 day EMA and 200 day EMA on

the chart.

|

| Click on Image to enlarge |

Once

the EMA lines are added, repeat the steps and add MACD also. After both EMA and

MACD added chart will look as follows

|

| Click on Image to enlarge |

Click

here to go directly to link that is already pre-configured with this set up

Once

the set-up is done, note the EMAs values on the top right corner of the chart.

Rules for Long

Term Trend Trading Game:

1.

In

the long term (2Y Chart) note 50, 100 and 200 EMAs. If the values are 50EMA>100EMA>200EMA

the long term trend is up and vice versa for down trend ie 50<100<200

EMAs

2.

In

the above scenario (if 50>100>200 EMAs) we should always look for long

opportunities in the intraday, shorter or medium term trading. And vice versa

for short opportunities.

3.

If

the price is too far (ie over 5% from the nearest EMA) there are two

possibilities to be noted

a) Wait for the Price to re-trace

towards EMA and enter trades in the direction of Moving Average Cross Over.

b) Look at MACD for divergence and

take counter trend trades with targets at EMA lines.

4.

If

trading with MACD cross over/divergence there are 2 types of trading

opportunities can be identified

a) Enter first position on MACD

cross over (Long positions if cross over is far below “0” and vice versa for

short) and enter the second position on the MACD lines crossing “0” line (Long

if crossing from below to above and vice versa)

b) Do not take position at first

cross but wait for the MACD lines to cross “0” line to take position in the

direction of cross over.

5.

The

trend following long trades occur when 50>100>200 and the price touches

these EMA lines with SL placed at next EMA line.

6.

Continuous

close above farthest line from the current price is required for the trend

reversal.

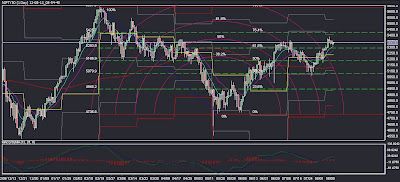

Example:

|

| Click on Image to enlarge |

In

the above example, since April 2012 the trend has been down for Nifty and

arrows marked in green on MACD are counter trend long opportunities and arrows

marked in red are trend following short opportunities. Circles marked in black

are EMA –ve cross over shorting opportunities. Circles marked in Green are long

trading opportunities in +ve trend and circles marked in red are short

opportunities in down trend.

Rules for

Trading intraday, short or medium term based on long term trend:

1.

Identify

the Long Term Trend on 2Y chart and move down to 5D chart where 1 tick/candle =

5 minutes.

2.

From

the above example we knew that the trend has turned to +ve on 31st July

2012 when the Nifty Price closed at 5230 (Last green circle on the right side

of the chart), so we should practically look for only Long Opportunities from

the start of August month!

3.

After

identifying trend on long term chart ie Long as of now, we shall move to 5D

chart by clicking 5D at the bottom of the chart. Note: The EMA lines drawn on

2Y chart will remain of 5D chart also (5D = 5 days price chart)

Example

of Trades:

|

| Click on Image to enlarge |

In the above chart circles &

arrows drawn in green are trend following Long Opportunities and Circle and

arrows drawn are counter trend short opportunities in Intraday.

Note: It is always advisable to

avoid counter trend trades in Intraday & short term as Stop Loss hit on

these trades will be more than the profit potential. Hence, as far as possible it

is better to stick to major trend and trade accordingly in Nifty. If Nifty’s trend

is clear even most stocks’ trends will also be the same. Stick to rules and

profits will follow…. Team MTT